Intel: Processors yay, otherwise lots of yikes

Processor growth was unable to compensate for the slump in other Intel divisions. In the end, a net loss of 381 million US dollars remained.

(Bild: heise online / mma)

Intel slipped back into the red at the start of 2024. With a turnover of 12.7 billion US dollars, the chip manufacturer posted a net loss of 381 million. The operating business was even worse, with a loss of almost 1.1 billion dollars. The difference between the operating and net loss was primarily due to tax refunds.

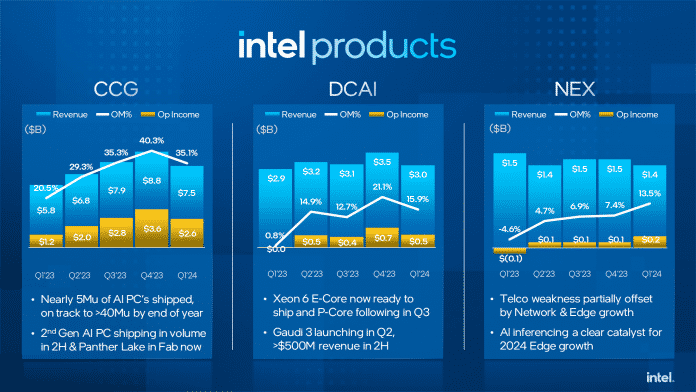

The Client Computing Group (CCG), which focuses on end customer products – i.e. primarily core processors for notebooks and desktop PCs, did well. It grew by 35 percent to 7.5 billion dollars in sales within a year. Operating profit more than doubled to 2.6 billion dollars. However, Intel also recorded a historic low at the beginning of 2023.

Intel states that just under five million notebooks with Core Ultra CPUs (Meteor Lake) were sold. With just under 60 million PC sales in the first quarter, this corresponds to a share of around eight percent.

Intels Quartalszahlen nach Sparten aufgeschlüsselt (3 Bilder)

Stagnation to slump

Sales in the two other core divisions relating to servers / data centers (DCAI) and network / edge (NEX) largely stagnated. However, Intel was able to increase its margin and thus its operating profits. Together, the two groups achieved a plus of around 700 million US dollars.

All other divisions looked disastrous, above all the chip contract manufacturing division Intel Foundry. Intel now also books internal production orders under this division, primarily for its own CPUs. As a result, it is no longer clear how much money the chip manufacturer earns from external customers.

However, the figures also show that Intel has so far financed chip production to a considerable extent with CPU sales. The foundry alone recently made an operating loss of 2.5 billion US dollars on a turnover of 4.4 billion.

The company's CEO Pat Gelsinger continues to focus everything on the 18A process generation, which will bring the first major wave of external customers. 18A production is scheduled to start in the first half of 2025 – According to Gelsinger, the first own CPU series Panther Lake and Clearwater Forest will be released in summer 2025. Panther Lake follows on from Arrow Lake and is expected to appear as the Core UItra 300. Clearwater Forest replaces the 288-E core Sierra Forest.

The FPGA subsidiary Altera and the automotive subsidiary Mobileye used to traditionally contribute several hundred million dollars in profit per quarter. Recently, however, things have gone downhill, resulting in a combined operating loss of 107 million dollars. With the results from the previous year, Intel would still have ended up with a minimal net profit.

In the current second quarter of 2024, Intel expects sales of 12.5 to 13.5 billion US dollars. On average, this would again mean a net loss of around 200 million dollars. The stock market is dissatisfied with the business figures – since the announcement, the share price has fallen by six percent.

Empfohlener redaktioneller Inhalt

Mit Ihrer Zustimmmung wird hier ein externer Preisvergleich (heise Preisvergleich) geladen.

Ich bin damit einverstanden, dass mir externe Inhalte angezeigt werden. Damit können personenbezogene Daten an Drittplattformen (heise Preisvergleich) übermittelt werden. Mehr dazu in unserer Datenschutzerklärung.

(mma)